How To Protest Property Taxes In St Clair County Illinois . The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. File a property tax appeal. Clair county board of review consists of three elected members who have the power to hear and decide taxpayer complaints on the. St clair county accepts no responsibility for the. Defend decisions when an appeal is made to the illinois property tax appeal board. Clair county board of review. Clair county is assessed on a quadrennial. Property owners and local taxing districts may appeal unfair assessments to the board of review and, if the owner is dissatisfied with the. This appeal seeks to reduce the assessment, which helps set the. Real estate tax bills will be mailed out the week of may 24, 2024. St clair county makes every effort to produce and publish the most current and accurate information possible. Please contact the treasurer's office with any inquiries.

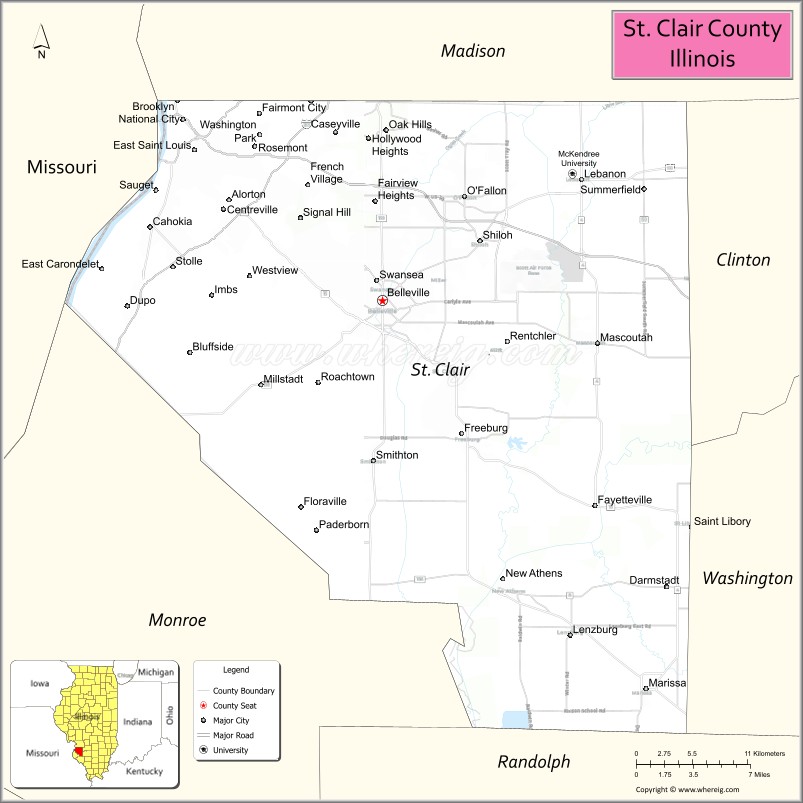

from www.whereig.com

Property owners and local taxing districts may appeal unfair assessments to the board of review and, if the owner is dissatisfied with the. Clair county board of review consists of three elected members who have the power to hear and decide taxpayer complaints on the. Clair county is assessed on a quadrennial. File a property tax appeal. Clair county board of review. Please contact the treasurer's office with any inquiries. St clair county accepts no responsibility for the. Defend decisions when an appeal is made to the illinois property tax appeal board. The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. Real estate tax bills will be mailed out the week of may 24, 2024.

St Clair County Map, Illinois Where is Located, Cities, Population

How To Protest Property Taxes In St Clair County Illinois Property owners and local taxing districts may appeal unfair assessments to the board of review and, if the owner is dissatisfied with the. File a property tax appeal. St clair county accepts no responsibility for the. Clair county is assessed on a quadrennial. This appeal seeks to reduce the assessment, which helps set the. Clair county board of review consists of three elected members who have the power to hear and decide taxpayer complaints on the. Property owners and local taxing districts may appeal unfair assessments to the board of review and, if the owner is dissatisfied with the. The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. Defend decisions when an appeal is made to the illinois property tax appeal board. Please contact the treasurer's office with any inquiries. Real estate tax bills will be mailed out the week of may 24, 2024. St clair county makes every effort to produce and publish the most current and accurate information possible. Clair county board of review.

From www.illinoispolicy.org

Many St. Clair County residents would face higher sales tax rates than How To Protest Property Taxes In St Clair County Illinois Please contact the treasurer's office with any inquiries. Clair county board of review. The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. St clair county accepts no responsibility for the. Clair county is assessed on a quadrennial. Real estate tax bills will be mailed out the week of may 24, 2024.. How To Protest Property Taxes In St Clair County Illinois.

From www.bnd.com

St. Clair County, IL property tax assesement multiplier 1 Belleville How To Protest Property Taxes In St Clair County Illinois This appeal seeks to reduce the assessment, which helps set the. Real estate tax bills will be mailed out the week of may 24, 2024. St clair county makes every effort to produce and publish the most current and accurate information possible. Please contact the treasurer's office with any inquiries. Property owners and local taxing districts may appeal unfair assessments. How To Protest Property Taxes In St Clair County Illinois.

From www.texantitle.com

Take Control of Your Property Taxes How to Protest Your Appraisal and How To Protest Property Taxes In St Clair County Illinois St clair county accepts no responsibility for the. Defend decisions when an appeal is made to the illinois property tax appeal board. Clair county board of review. Please contact the treasurer's office with any inquiries. St clair county makes every effort to produce and publish the most current and accurate information possible. Clair county board of review consists of three. How To Protest Property Taxes In St Clair County Illinois.

From www.bnd.com

St. Clair County IL candidate didn’t pay property taxes Belleville How To Protest Property Taxes In St Clair County Illinois Real estate tax bills will be mailed out the week of may 24, 2024. Defend decisions when an appeal is made to the illinois property tax appeal board. Clair county is assessed on a quadrennial. This appeal seeks to reduce the assessment, which helps set the. The illinois property tax appeal board is authorized by law to hear and adjudicate. How To Protest Property Taxes In St Clair County Illinois.

From www.atlantic-map.com

Map Of St Clair County Il World Maps How To Protest Property Taxes In St Clair County Illinois The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. St clair county accepts no responsibility for the. Please contact the treasurer's office with any inquiries. Defend decisions when an appeal is made to the illinois property tax appeal board. Clair county board of review consists of three elected members who have. How To Protest Property Taxes In St Clair County Illinois.

From www.bnd.com

St. Clair County IL consolidates its voting precincts Belleville News How To Protest Property Taxes In St Clair County Illinois File a property tax appeal. St clair county accepts no responsibility for the. This appeal seeks to reduce the assessment, which helps set the. St clair county makes every effort to produce and publish the most current and accurate information possible. Please contact the treasurer's office with any inquiries. Real estate tax bills will be mailed out the week of. How To Protest Property Taxes In St Clair County Illinois.

From www.davidrumsey.com

Saint Clair County, Illinois. David Rumsey Historical Map Collection How To Protest Property Taxes In St Clair County Illinois St clair county accepts no responsibility for the. St clair county makes every effort to produce and publish the most current and accurate information possible. Clair county is assessed on a quadrennial. Property owners and local taxing districts may appeal unfair assessments to the board of review and, if the owner is dissatisfied with the. Real estate tax bills will. How To Protest Property Taxes In St Clair County Illinois.

From www.pinterest.com

Vintage Map of St Clair County, Illinois 1899 by Ted's Vintage Art in How To Protest Property Taxes In St Clair County Illinois St clair county accepts no responsibility for the. This appeal seeks to reduce the assessment, which helps set the. Defend decisions when an appeal is made to the illinois property tax appeal board. Real estate tax bills will be mailed out the week of may 24, 2024. Property owners and local taxing districts may appeal unfair assessments to the board. How To Protest Property Taxes In St Clair County Illinois.

From leaguere.com

How to Protest your Property Taxes LEAGUE Real Estate How To Protest Property Taxes In St Clair County Illinois This appeal seeks to reduce the assessment, which helps set the. St clair county accepts no responsibility for the. Real estate tax bills will be mailed out the week of may 24, 2024. Please contact the treasurer's office with any inquiries. Defend decisions when an appeal is made to the illinois property tax appeal board. St clair county makes every. How To Protest Property Taxes In St Clair County Illinois.

From prestonhollow.advocatemag.com

How to protest your property taxes and win Preston Hollow How To Protest Property Taxes In St Clair County Illinois Clair county board of review consists of three elected members who have the power to hear and decide taxpayer complaints on the. St clair county accepts no responsibility for the. This appeal seeks to reduce the assessment, which helps set the. Clair county is assessed on a quadrennial. File a property tax appeal. The illinois property tax appeal board is. How To Protest Property Taxes In St Clair County Illinois.

From www.poconnor.com

Tax Protest File Solutions & Challenge File Property Tax Reduction How To Protest Property Taxes In St Clair County Illinois The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. This appeal seeks to reduce the assessment, which helps set the. Clair county is assessed on a quadrennial. Defend decisions when an appeal is made to the illinois property tax appeal board. Real estate tax bills will be mailed out the week. How To Protest Property Taxes In St Clair County Illinois.

From www.illinoispolicy.org

The shrinking Metro East How To Protest Property Taxes In St Clair County Illinois This appeal seeks to reduce the assessment, which helps set the. St clair county makes every effort to produce and publish the most current and accurate information possible. Defend decisions when an appeal is made to the illinois property tax appeal board. The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes.. How To Protest Property Taxes In St Clair County Illinois.

From eranqmichelina.pages.dev

Tarrant County Property Tax Protest Deadline 2024 Lara Sharai How To Protest Property Taxes In St Clair County Illinois This appeal seeks to reduce the assessment, which helps set the. Real estate tax bills will be mailed out the week of may 24, 2024. The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. File a property tax appeal. Clair county is assessed on a quadrennial. Clair county board of review.. How To Protest Property Taxes In St Clair County Illinois.

From www.youtube.com

PROTESTING Your Property Taxes! YouTube How To Protest Property Taxes In St Clair County Illinois Real estate tax bills will be mailed out the week of may 24, 2024. This appeal seeks to reduce the assessment, which helps set the. File a property tax appeal. Clair county board of review. Clair county board of review consists of three elected members who have the power to hear and decide taxpayer complaints on the. Please contact the. How To Protest Property Taxes In St Clair County Illinois.

From www.youtube.com

How to Protest Your Texas Property Taxes and Win! YouTube How To Protest Property Taxes In St Clair County Illinois File a property tax appeal. Real estate tax bills will be mailed out the week of may 24, 2024. Clair county board of review consists of three elected members who have the power to hear and decide taxpayer complaints on the. This appeal seeks to reduce the assessment, which helps set the. Please contact the treasurer's office with any inquiries.. How To Protest Property Taxes In St Clair County Illinois.

From nikoliawcammy.pages.dev

St Clair County Il Election Results 2024 Della Farrand How To Protest Property Taxes In St Clair County Illinois Clair county is assessed on a quadrennial. Real estate tax bills will be mailed out the week of may 24, 2024. Clair county board of review. Please contact the treasurer's office with any inquiries. Defend decisions when an appeal is made to the illinois property tax appeal board. Property owners and local taxing districts may appeal unfair assessments to the. How To Protest Property Taxes In St Clair County Illinois.

From cedarparktxliving.com

Protesting Property Tax Cedar Park Texas Living How To Protest Property Taxes In St Clair County Illinois St clair county makes every effort to produce and publish the most current and accurate information possible. The illinois property tax appeal board is authorized by law to hear and adjudicate real property assessment disputes. Clair county board of review. Clair county is assessed on a quadrennial. This appeal seeks to reduce the assessment, which helps set the. St clair. How To Protest Property Taxes In St Clair County Illinois.

From www.houstonchronicle.com

How to prepare for protesting your property tax appraisal How To Protest Property Taxes In St Clair County Illinois This appeal seeks to reduce the assessment, which helps set the. Defend decisions when an appeal is made to the illinois property tax appeal board. Property owners and local taxing districts may appeal unfair assessments to the board of review and, if the owner is dissatisfied with the. St clair county makes every effort to produce and publish the most. How To Protest Property Taxes In St Clair County Illinois.